ERP systems such as SAP Business One, Oracle NetSuite and Microsoft Dynamics streamline main business processes including resource tracking and manages commitments such as orders, purchase orders and payroll. Typically, they are not designed to work as electronic invoicing platforms. The way how invoices can be designed, integrated and sent are limited and customization of a standard ERP implementation implies a considerable amount of IT resources and costs.

Invoicing Extension

Extracting the invoicing as a dedicated process layer that runs separately, but connected to your ERP system, provides a reliable and streamlined way to manage electronic invoicing. This enables businesses to keep the invoicing layer when switching ERP systems or significant changes are made to existing ERP implementations.

Using TX Text Control, invoices can be designed, managed and created based on standard templates and data from all ERP systems using standard APIs.

Text Control Consulting

Outsourcing the process to an expert offers the best combination of Text Control technology and service to integrate, manage and maintain an electronic invoicing process. We can help you with your project to integrate a streamlined document processing into your existing ERP infrastructure.

Electronic invoicing processes help to save costs of between 60 and 80% compared to paper-based invoicing processes. Other significant advantages of digitizing these processes are reduced entry errors, quicker turnaround times and potentially increased cash discounts. Legally, more and more governments require electronic invoices for governmental contracts.

Lower Costs

Electronic invoicing reduces costs by 60 to 80%.

Higher Compliance

Efficient and more transparent processes and therefore better comply with legal requirements.

Security

Using encrypted transmission procedures increase security and compliance.

Better Cash Flow

Shorten time to payment and improve cash flow.

There are different formats for electronic invoices:

- Pure structured data (e.g. EDI, XML)

- Unstructured data (PDF/TIF, MS Word format, text, HTML)

- Hybrid data (ZUGFeRD, Factur-X)

Electronic Invoice Standard

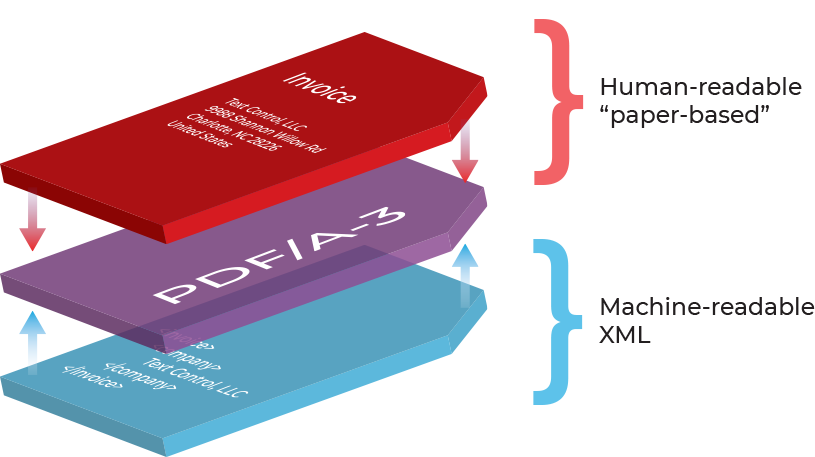

The ZUGFeRD / Factur-X standard is a hybrid electronic invoice format that consists of two parts:

- A PDF visual, human-readable representation of the invoice.

- An XML file that contains invoice data in a structured form that can be processed automatically.

PDF/A-3 allows attachments in any format to be added to PDF documents. The standard itself doesn't standardize the embedded documents, but the way how they are embedded in the PDF structure. This enables applications to reliably extract the attached document from the PDF document which enables readers to extract only the embedded documents without having to open the complete PDF document itself.

In case of the electronic invoice, a machine-readable part can be embedded (such as XML). The processing application is not specialized in reading PDF documents, but is able to extract the structured attachment which is then processed by the commercial software that is able to read this attachment.

Legal Requirements

In many countries including Germany, there are regulations and new laws regarding electronic invoices. The tax simplification law (Steuervereinfachungsgesetz 2011) is equating the electronic invoice with the traditional, printed invoice. This law is based on an EU directive for invoice processing for public purchasing and government bids. This law should streamline business processes in order to make them more efficient.

Based on the directive, an electronic invoice must consist of the following required components:

- The receiver must consent to receive electronic invoices (or not opt-out).

- The invoice must be created, send, received and processed in an electronic format.

- The invoice must be readable by humans.

- The origin and authenticity needs to be provable.

- The invoice integrity must be guaranteed.

- Typical mandatory invoice details must exist (tax identification number, ...).

ZUGFeRD / Factur-X

ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a specification for a format that describes electronic invoices. A ZUGFeRD invoice consists of two parts: The visual representation of an invoice that is readable by humans and machine-readable structured XML information which is attached to the PDF/A-3 document.

The advantage of such a document is that the embedded file can be easily processed by machines and the document itself can be visualized by any standard PDF reader and is therefore robustly archivable backed by the original PDF/A idea.

Text Control Consulting

We can help you with your electronic invoicing implementation. Use the know-how of our experts we gained from many projects and document processing implementations.

Text Control Consulting

Outsourcing the process to an expert offers the best combination of Text Control technology and service to integrate, manage and maintain an electronic invoicing process. We can help you with your project to integrate a streamlined document processing into your existing ERP infrastructure.