The State of Electronic and Digital Signatures (E-Signatures) in Business Applications (2025)

Electronic signatures are no longer just a "nice-to-have" workflow upgrade. By 2025, they had become infrastructure. A critical component of modern business applications. This article explores the current state of e-signatures, including their benefits, challenges, and future trends.

Electronic signatures are no longer just a "nice-to-have" workflow upgrade. By 2025, they had become infrastructure, embedded in HR onboarding, procurement, customer portals, CLM/CRM pipelines, and regulated flows demanding strong identity proofing.

The change isn't just in the number of documents signed electronically, but also in where the signing capability lives (inside core business apps), the level of assurance expected (identity and auditability), and how regulators and standards influence the edge cases that still require wet ink.

Electronic vs digital signatures: Why the distinction matters in 2025

In business discussions, "e-signature" can refer to anything from typing your name to cryptographic signing with strong identity checks. By 2025, this distinction will matter more than ever. While electronic signatures, such as clicking "I agree," are common for low-risk documents, digital signatures, which are cryptographically secured, are required for high-value contracts, regulated industries, and cross-border agreements.

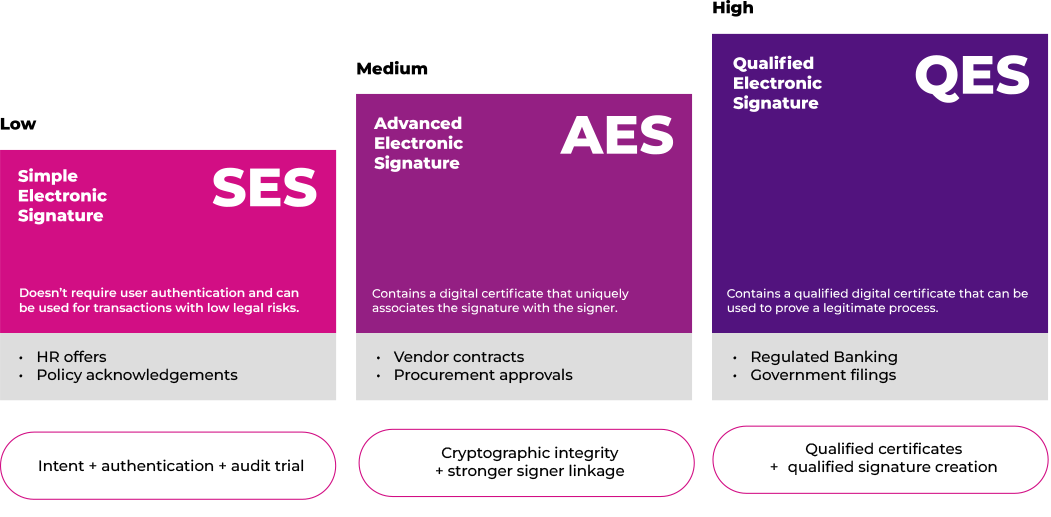

A useful way to think about 2025 is to use a signature assurance ladder:

- Level 1: Simple Electronic Signatures (SES) - Basic methods like typed names or checkboxes, suitable for low-risk agreements.

- Level 2: Advanced Electronic Signatures (AES) - Tied to the signer's identity and linked to the signed data, often using multi-factor authentication.

- Level 3: Qualified Electronic Signatures (QES) - The highest assurance level, using a qualified certificate issued by a trusted provider, legally equivalent to handwritten signatures in many jurisdictions.

This ladder matters because, in 2025, adoption growth will be increasingly about transitioning from (1) to (2) or (3) for higher-risk workflows, rather than merely replacing paper.

Adoption in 2025: Mainstream, hybrid, and increasingly embedded

By 2025, electronic signatures are mainstream across industries and geographies. However, adoption patterns vary:

- E-signatures have become mainstream: Most organizations use e-signatures, especially for high-volume agreements in areas such as human resources, sales, procurement, and service enrollments.

- Hybrid approaches persist: Many organizations use e-signatures for most workflows but still require wet ink signatures for a shrinking subset of processes, including notarization, certain formalities, transactions with legacy counterparties, and processes that require specific jurisdiction.

- Embedded signing experiences: By 2025, the majority of e-signature transactions occur within core business applications (e.g., CRM, ERP, HRIS) rather than standalone e-signature platforms. This embedding improves user experience and compliance.

How many companies use e-signatures vs wet ink?

Since there is no global census in 2025, most hard numbers come from a mix of market research, vendor surveys, and industry-specific adoption indicators.

A commonly cited range from industry roundups is that 60-80% of organizations have adopted e-signatures to some extent, while 20-40% still rely on paper-based signatures for at least some workflows. Treat these figures as general trends rather than definitive statistics, as the methodology varies and "adoption" is defined differently across surveys.1

For a more detailed industry overview, one market report notes the high adoption of e-signature software in legal workflows, citing figures for 2024. This reinforces the idea that professional services have transitioned to a digital model.2

The shift from "send to DocuSign" to embedded, API-driven signing

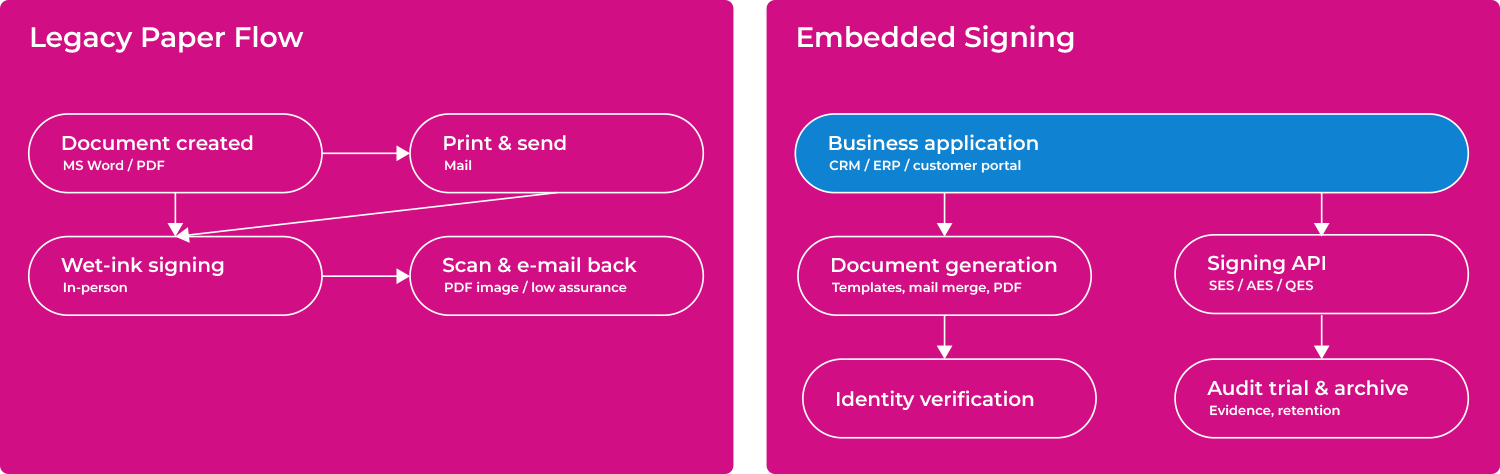

The big shift in 2025 isn't just "more e-signatures". It's where signing occurs. Many organizations are shifting from standalone signing portals - such as sending documents to services like DocuSign - to direct integration within ERP and other line-of-business systems.

This change keeps the entire workflow in one place. The ERP generates the document from structured data, triggers signing via an embedded step, and stores the signed file and supporting documentation on the transaction. The result is less context switching, fewer manual handoffs, cleaner audit trails, and policy-driven routing (simple signatures for low-risk cases and stronger identity and signature levels when the ERP detects higher risk or regulatory requirements).

The following diagram illustrates the difference between legacy e-signature processes and modern, embedded signing experiences in 2025:

Adoption vs previous years: The clearest proxy is market growth

Although exact adoption rates are difficult to determine, market growth provides a useful proxy. Over the past five years, the global digital signature market has grown rapidly, with CAGR estimates ranging from 20-30%. This growth reflects new adopters as well as existing users expanding their usage to higher-assurance signatures and more embedded workflows.

Grand View Research estimates3 the global digital signature market size at:

- $5.2B market size (2024)

- projected to reach $38.16B by 2030, with a 40.5% CAGR (Compound Annual Growth Rate) (2025-2030)

This trajectory reflects what many organizations have experienced: In the early years, e-signatures were often standalone tools adopted by a single department for a limited number of documents. By 2025, however, e-signatures had evolved into platform capabilities deeply integrated into end-to-end workflows. They were tied to identity and authentication, aligned with compliance requirements, and connected to records retention and audit trails.

Legal landscape in 2025: Maturing regulations and global harmonization

In the United States, electronic signatures have a stable, long-established legal foundation, and day-to-day practices are constantly modernizing, especially regarding identity proofing and notarization.

The federal ESIGN Act (15 U.S.C. § 7001) establishes that a signature, contract, or record cannot be rejected solely because it is electronic. The same applies to contracts formed using electronic records or signatures.

Additionally, most states adhere to a consistent framework through the Uniform Electronic Transactions Act (UETA). UETA has been widely adopted across the U.S., though New York is a notable exception; it relies on its own electronic signature law rather than UETA.

A concrete sign of recent modernization is not the basic enforceability rule, but rather, how regulated workflows increasingly accept electronic and remote online notarization (RON). For instance, the SEC's filer support guidance for Form ID directs applicants to electronic or remote online notarization options in the EDGAR Filer Manual.4

In Europe, eIDAS (Regulation (EU) No 910/2014) is the primary legal framework governing electronic signatures and trust services. One key issue that continues to impact many implementations by 2025 is the legal status of qualified electronic signatures (QESs). Under eIDAS, a QES has the same legal effect as a handwritten signature. This principle is stated in the regulation itself and reiterated in European Commission guidance.

The most recent shift is eIDAS 2.0, which establishes the European Digital Identity framework. Enacted through Regulation (EU) 2024/1183, this update amends the original eIDAS regulation and provides the legal basis for the EU Digital Identity Wallet ecosystem.

Outlook: Embedded signing is accelerating and that plays to Text Control's strengths

Looking ahead, it's clear that the momentum is shifting toward signing as a native step within business applications. Organizations don't want "just another portal." They want signing to happen directly within the systems where work already occurs: ERP, CRM, HR, CLM, and customer portals. This trend favors vendors who can provide a consistent user experience, reliable document rendering, and programmable workflows from start to finish.

Text Control excels in these areas. Rather than forcing customers to push documents to a separate service and UI, we focus on embeddable document technology and developer-first APIs that enable teams to build signing workflows directly into their applications. That means:

- Document generation and consistency: Produce the exact document that will be signed from templates and structured data, inside the application flow.

- Signature-ready output: Create PDFs and forms that behave predictably across viewers, and provide the structure needed for downstream processing and archiving.

- Workflow control and integration: Keep approvals, business rules, and transaction context in the ERP rather than distributing it across email threads and external tools.

- Evidence and compliance readiness: Support the auditability and integrity requirements that become more important as organizations move from "simple e-sign" toward higher-assurance scenarios.

The outlook for 2026 and beyond is less about convincing organizations to use electronic signatures and more about helping them to industrialize the signing process. This includes policy-driven assurance levels, stronger identity verification, clean audit trails, and long-term retention. As embedded signing becomes the default expectation, the focus shifts to platforms that enable developers to build the entire experience within their product. Text Control is built for that lane.

Our engineers can work with you to analyze your current workflow and help you begin the process of embedding signing into your application. Contact us to learn more about how Text Control can support your e-signature needs in 2025 and beyond.

References

1 eSignature Statistics 2025: Adoption, Impact & Industry Trends

2 Digital Signature Market Size, Share & Industry Analysis

3 Digital Signature Market (2025-2030)

4 Prepare and Submit My Form ID Application for EDGAR Access

ASP.NET

Integrate document processing into your applications to create documents such as PDFs and MS Word documents, including client-side document editing, viewing, and electronic signatures.

- Angular

- Blazor

- React

- JavaScript

- ASP.NET MVC, ASP.NET Core, and WebForms

Related Posts

NDC London 2026 Wrap-Up: Conversations, Community, and a Conference Done Right

NDC London 2026 was an incredible experience filled with insightful conversations, a strong sense of community, and a well-organized conference that catered to developers' needs. Here's a wrap-up…

Procurement Comparison: TX Text Control .NET Server vs Aspose (Words + PDF)

A detailed cost comparison between TX Text Control .NET Server and Aspose.Words + Aspose.PDF for document generation and processing in .NET applications. Discover the advantages of using TX Text…

Looking Ahead: Our Conference Journey in 2026

We just wrapped up our last conference of 2025 in Cologne. While the year has come to a close, we're already looking ahead to what's next. At Text Control, we start planning for the upcoming…

We are Returning to CodeMash 2026 as a Sponsor and Exhibitor

We are excited to announce that we will be returning to CodeMash 2026 as a sponsor and exhibitor. Join us to learn about the latest in .NET development and how our products can help you build…

Scaling TX Text Control Document Editor Applications

Learn how to scale TX Text Control Document Editor applications effectively for enhanced performance and user experience. A practical guide for high performance architectures.