Adoption of Electronic vs. Paper Signatures in 2025

The move to electronic signatures has accelerated in recent years. However, many organizations still rely on paper signatures for core processes. This article examines the current state of electronic signatures, their benefits, and the challenges organizations face in implementing them.

The push toward electronic signatures (e-signatures) has accelerated in recent years, but many organizations still rely on paper ("wet ink") signatures for core processes. Surveys indicate that approximately three-quarters of organizations still use a mix of paper-based and digital document workflows.

This means that only a minority have completely eliminated paper signatures, even though adoption of e-signature solutions is growing rapidly across all industries. Looking across industries in the U.S. and Europe, the trend is accelerating, but there is still significant room for growth.

Paper vs. Digital: A Sector-by-Sector Breakdown

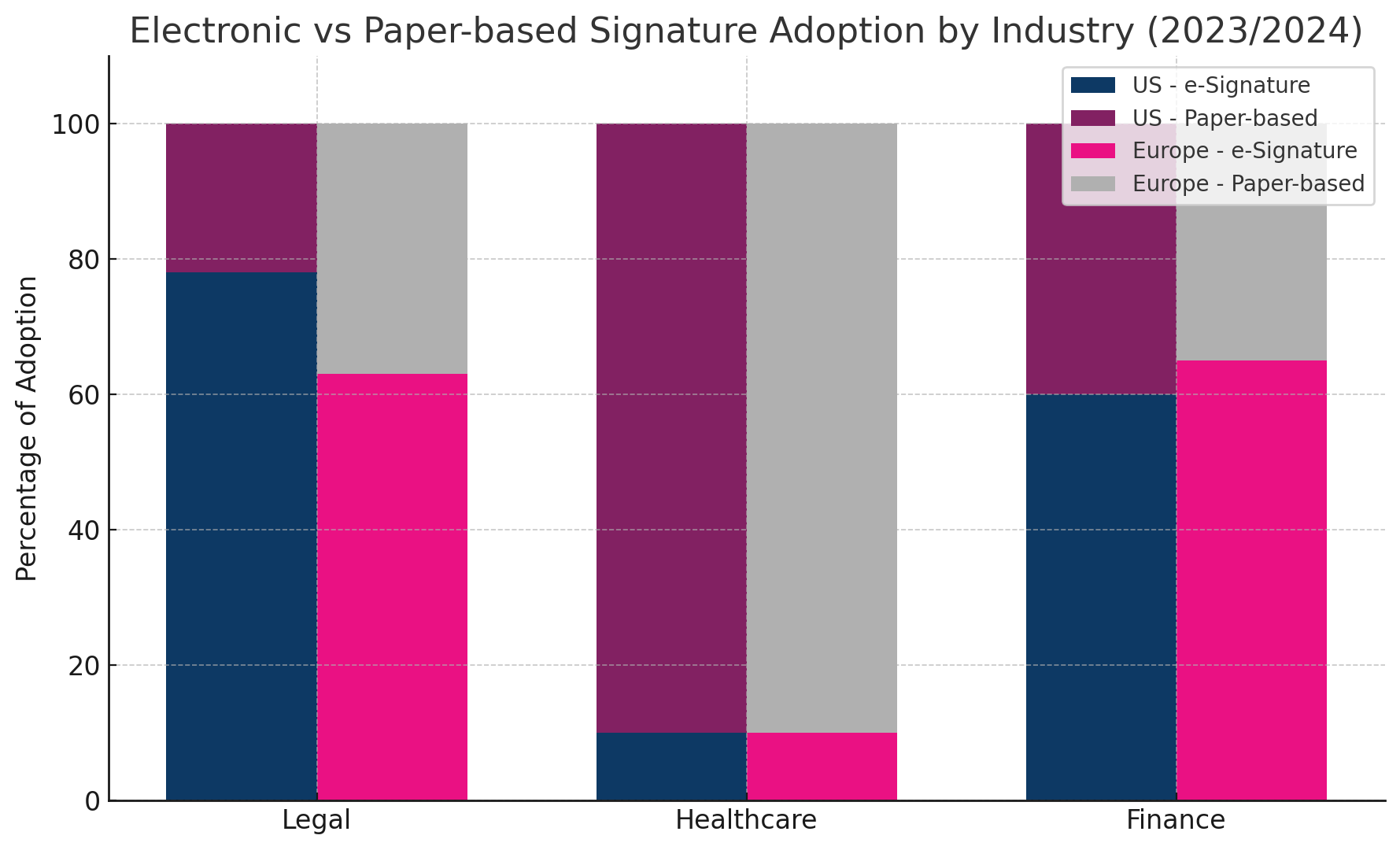

To compare e-signature adoption across three key industries (legal, healthcare, and finance) we analyzed the most recent data (2023-2024).

Legal Industry

The legal sector has embraced e-signatures to a large extent, especially in the U.S. A recent legal technology report found that 78% of law firms have adopted electronic signature tools as part of their remote-working tech stack.1 This means that approximately 22% of organizations still rely primarily on paper signatures for these processes. European legal teams are also catching up, with approximately 63% of organizations reporting the use of electronic signatures in their legal processes.2

The main driver for the move to electronic signature processes was in part the COVID-19 pandemic, which forces processes to be online and remote. Electronic signatures also save time and can reduce turnaround times for contracts and filings, improving customer service. In particular, a survey of law firms in 2024 shows that electronic signatures are now considered to be critical to the business continuity of legal operations.3

In Europe, supportive regulations (eIDAS) have increased confidence in the legality of electronic signatures, encouraging more and more law firms to go digital.

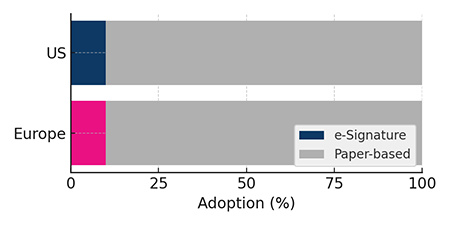

Healthcare Industry

Healthcare has been historically slow to digitize, and a large portion of healthcare organizations still use paper-based signatures for many core workflows, such as patient intake forms, consent forms, and medical records. Research shows that by 2023, only about 7% of healthcare and pharmaceutical companies consider their processes to be fully digital.4 This means that the vast majority of healthcare organizations still use a mix of paper and digital signatures.

On the other hand, healthcare is beginning to adopt e-signatures more broadly: Health and life sciences now account for about 14% of global digital signature users.5 But it's common in both U.S. and European healthcare for critical processes to involve paper. Many organizations remain hybrid, using electronic signatures in some departments and paper in others.

Driving factors are telemedicine and remote patient care, which make electronic consent and intake forms a necessity when patients cannot sign in person. In addition, compliance and security requirements are driving this trend. E-signature solutions can meet HIPAA requirements by securely authenticating signers and maintaining audit trails, which is often more secure than handling paper forms.

In the U.S., many providers still use paper out of habit or concern for elderly patients, and in Europe, some national healthcare systems require qualified electronic signatures or have legacy paper processes that will take time to replace. However, the overall trend is that both the U.S. and European healthcare sectors are steadily moving toward electronic signatures for efficiency. Just at a slower pace than other industries, with paper-based signatures still common in 2023.7

Financial Services

The Banking, Financial Services and Insurance (BFSI) sector is leading the world in e-signature adoption. BFSI organizations have some of the highest rates of e-signature adoption, representing approximately 26.2% of global e-signature users, the largest share by industry6.

Virtually all major banks and insurance companies in the U.S. and Europe use e-signature solutions for at least some of their processes (loan applications, new account openings, policy enrollments, etc.).

Many European banks have adopted e-signature solutions for online banking and insurance policy agreements, thanks to Europe's robust digital banking culture and regulatory support (e.g., eIDAS and Open Banking rules).

Overall, most financial firms have at least partially digitized their signing processes. For instance, when given the option, over 90% of bank customers choose to e-sign documents rather than sign paper for things like new account openings. This shows how common and expected digital signatures have become in the financial industry.

Adoption in the financial sector is being driven by a combination of customer demand, competitive pressures, and compliance requirements. Customers now expect to be able to open accounts, apply for loans, or sign insurance documents online without visiting a branch, and this expectation skyrocketed during the pandemic.

There are also clear efficiency gains: e-signatures can dramatically reduce contract processing time (a DocuSign study found that companies saw a 28% reduction in time to revenue after implementing e-signatures) and save on printing and mailing costs.8 Regulations in both the U.S. (ESIGN Act, UETA) and the EU (eIDAS) give full legal validity to electronic signatures, which has alleviated some of the earlier hesitation.

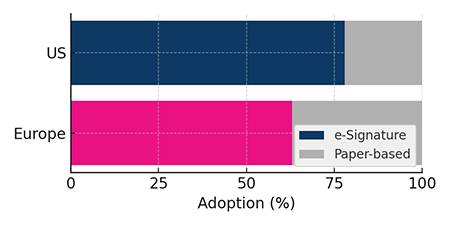

U.S. vs. Europe: Key Differences and Trends

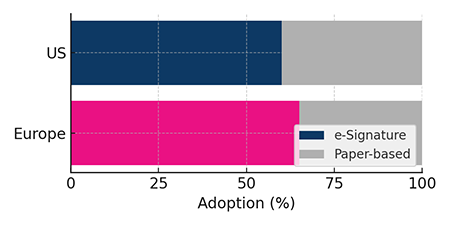

Both the United States and Europe have seen a dramatic increase in the adoption of e-signatures across industries, especially since 2020. Overall, the gap between the US and European markets is narrowing. In fact, North America and Europe are the two regions that are adopting e-signatures at the highest rates in the world.9

The U.S. was an early adopter (thanks to the ESIGN Act of 2000, which legalized e-signatures at the federal level), giving industries such as real estate and finance in the U.S. a head start in going paperless. Wider adoption in Europe picked up after the 2016 eIDAS regulation, which created a uniform legal framework for e-signatures across EU member states.

In many industries, U.S. organizations report slightly higher current use of e-signatures. European companies also often report high adoption, but may include more hybrid workflows (e.g., remember that about 72% of European companies still use a mix of electronic and paper documents rather than going 100% digital).10

In a global survey, 66% of large companies and 49% of smaller companies now say they are "digital-first" in how they operate, which includes using e-signatures over paper wherever possible.11 For example, 65% of U.S. companies that still use paper say that tracking physical signatures adds a full day to their workflow.12

In summary, both the U.S. and Europe are embracing electronic signatures in the legal, healthcare, financial, and other sectors. Exact adoption rates vary by industry, but in general, 20-40% of organizations (depending on the industry) still rely on paper-based signatures, while 60-80% have adopted some level of e-signature technology.

Conclusion

As we move into 2025, the trend toward electronic signatures is expected to continue. The COVID-19 pandemic has accelerated the shift to digital processes, and organizations are increasingly recognizing the benefits of e-signatures in terms of efficiency, security, and customer satisfaction.

The transition away from paper is well underway, but not complete. The legal and financial industries are ahead of the curve, while the healthcare industry still has some catching up to do. As the tools become more secure, easier to use, and compliant, electronic signatures are quickly becoming the standard, not the exception.

How TX Text Control Supports e-Signature Integration in Legal, Healthcare, and Finance

As legal, healthcare and financial services organizations embrace digital transformation, the need for flexible, developer-friendly eSignature solutions has never been greater. These industries require not only secure and compliant e-signature workflows, but also customizable integration with existing systems and processes.

Without relying on third-party platforms such as DocuSign and Adobe Sign or compromising control and compliance, Text Control provides the building blocks for developers to create secure, document-driven applications with integrated electronic signature workflows.

Embedded Electronic Signatures with TX Text Control

TX Text Control provides a powerful API for developers to create custom e-signature workflows that meet the unique needs of their organizations. With TX Text Control, developers can create applications that allow users to electronically sign documents, track signatures and manage the entire signing process from within their own systems.

- Built-in support for legally binding electronic signatures.

- Signature fields and certificate-based signing directly in MS Word-compatible documents and PDFs.

- Document life cycle: Generate, pre-fill, sign, track - all within your application.

- Support for local, on-premises, and cloud-based workflows, depending on your data sensitivity requirements.

Whether you're building a contract management tool for law firms, a secure patient intake system for hospitals, or a loan processing application for banks, TX Text Control gives you the tools to generate dynamic, fillable documents using MailMerge or form fields; integrate signature workflows with user authentication and timestamping; maintain a complete audit trail and prevent tampering with document sealing and signature validation; and embed signing UIs directly into your ASP.NET Core, Angular, or JavaScript applications.

Built for developers in regulated industries, our core verticals of legal, healthcare, and finance rely on solutions that combine document automation with trusted signature workflows. That's why we provide SDKs for .NET and Angular, server-side libraries for document generation and digital signing, a powerful, embeddable DocumentViewer for reviewing and signing documents directly in your web application, and seamless integration with existing identity providers for signer authentication.

1,3 AffiniPay's 2025 Legal Industry Report Portrays A Profession At A Technological Crossroads

2,5,6 E-signature and Digital Document Statistics By Market Size, Usage and Facts

4 Digital Transformation in Healthcare in 2025: 7 Key Trends

7 How Two Financial Institutions Dusted Off E-Signature and Won Adoption

8 The Rapid Expansion of the Electronic Signature Market

9 The Top 5 Trends In The Electronic Signature Industry In 2023

10 Europe Digital Signature Market Size, Share & Industry Analysis

ASP.NET

Integrate document processing into your applications to create documents such as PDFs and MS Word documents, including client-side document editing, viewing, and electronic signatures.

- Angular

- Blazor

- React

- JavaScript

- ASP.NET MVC, ASP.NET Core, and WebForms

Related Posts

E-Sign Comes to Blazor: Document Viewer 33.0.1 Released

We are excited to announce the release of TX Text Control Document Viewer 33.0.1 for Blazor! This version comes packed with one of the most requested features: Electronic signature support.

E-Signing Reference Implementation in .NET C#: An Overview

In this article, we will provide an overview of the reference implementation of our e-signing functionality in .NET C#. It uses TX Text Control components such as the editor, viewer and PDF…

ASP.NETASP.NET CoreDocument Editor

Preparing Documents for E-Signing for Multiple Signers in .NET C#

Learn how to prepare documents for e-signing by multiple signers in .NET C#. This article shows how to create signature fields and how to assign them to signers.

ASP.NETASP.NET CoreDocument Viewer

Optimizing Digital Signature Workflows: Starting with MS Word DOCX Files…

Starting a digital signature workflow with MS Word DOCX files instead of PDFs provides greater flexibility, ease of editing, and collaboration during the document preparation phase. DOCX files are…

Sign Documents with a Self-Signed Digital ID From Adobe Acrobat Reader in…

This article shows how to create a self-signed digital ID using Adobe Acrobat Reader and how to use it to sign documents in .NET C#. The article also shows how to create a PDF document with a…